The most hotly debated topic and the words that we read in the papers related to the weather these days is the phenomenon of El Nino. As such I decided to do some research on the same to see what impact it has actually had on monsoons in the past. This phenomenon is also being widely watched in the Western economies as the advent of El Nino is supposed to bring cooler weather and rains to North America. The Indian Meteorological Departments claim has been that El Nino is just one of the factors affecting rains and the rains will be 96% of Long Term Average irrespective of the deficient rains in June. The Long Term Average itself is a suspect figure under today’s circumstances. The average rainfall over the LT Average ( which is a multidecade data point) is much higher than the average rainfall India has actually got over the last 10 years. As such maybe weather patterns are changing and it makes sense to compare rains with the last 10 year average rather than a much more longer term one. The Avg rainfall over the last 10 years has been just around 94-95% of the LT Avg. This implies that if we actually get 96% this year it will be more than the average of the last 10 years.

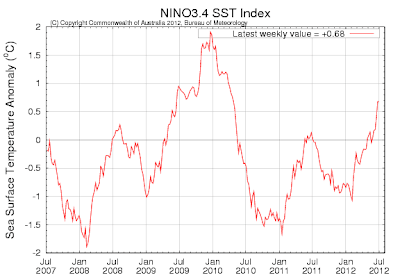

The other key point has been El Nino where I got hold of the following chart which shows a similar El Nino as is being currently forecasted develop in 2009 too.

This chart shows a very similar pattern for 2012 as was in 2009 and in that year we got normal rains. As such the IMD (atleast on this issue) seems to be right that just this phenomenon cannot take rainfall into great deficit.

Is Buy and Hold Dead – In today’s era of Hedge Funds, Algo Trading, huge market swings etc. one debate that I have heard is that the phenomenon of Buy&Hold which was the classic investment style of all the old masters of investing is now dead and traders do much better. I do not really believe that to be true. I think that most people tend to be swayed by short term phenomenon and consider that to be the one which will last forever. The amount and quality of money that can be made by identifying the right stocks at the right valuations and holding them over the long run can never be replicated by traders.

Markets tend to have their own investment cycles, in some traders do better and in others investors do better. For example in the period 2003-2007 one had to just identify the right sectors and stocks, specially in the years 2003/2004 and buy and hold them to make huge money. That was the time when valuations were cheap and there was disbelief in the markets ( similar to the current market scenario). Since most people who invest in the markets had passed through the phenomenon of 2000-2002 the general belief was that equity is a bad word and there is no sense investing in equity for the long run. At that time the memories of the dot com bust were fresh in the minds of people and today the memories of 2008 are still fresh.

The last three years have been tough for buy and hold investors except for the ones that have focused on defensive’s and have bought largely into FMCG/Pharma stocks where stocks have done well and valuations have continuously expanded. Ex of a very few stocks the last 3 years have seen a continuous derating of the markets across sectors and companies. As such buy & hold investors who were into defensive’s have still done well, but a vast majority of investors who largely invest in the broader markets and into riskier stocks have not done well.

Moreover the last four years have seen two of the worst years in the history of Indian stock markets i.e 2008 & 2011. Under the circumstances risk aversion has grown and most investors have become traders where they are scared to hold anything for the long term. However this phenomenon could be coming to an end at some stage in the near future as the downside risks to growth have subsided substantially and cheap valuations at a time of peak interest rates creates an ideal situation to buy the right stocks and play for the long haul. Indian markets over the long run have delivered close to 20% returns, however the last 5 years have seen negative returns. There is no reason to believe that similar averages will not be maintained over the long run and periods of negative return are usually followed by periods of above average returns. Buy and Hold is very much alive and it will return with a vengeance.

Indian 10 year bond yields

The chart of the Indian 10 year bonds is showing an interesting trend technically. Although the current expectations are that there is unlikely to be any significant easing from the RBI in the near term the charts seem to reflect something different.

Indian 10 year bond yields are in the process of forming a classic head and shoulder pattern with neckline at 8.2%. The bond has already broken below this level and if this level is sustained during the week it implies further downside to yields to levels of a minimum of 7.85-7.9%. The bond yields have also broken below the upward sloping concurrent trendlines. This could be an indicator of further monetary easing from the RBI.

Next weeks inflation data will become important in this regard.

MARKETS

Stock markets continue to trade at cheap valuations and with India India

The current quarter seems to be starting in a constructive manner, lets see how it plays out.