In a slow global environment cheap suppliers credit or import credit to the buyers has become an important competitive tool over the last 3-4 years. On this front Indian manufacturers just cannot compete as the interest rate differentials are too high. In a different context, we saw that over the last few months in order to beat the slowdown luxury car makers from Europe offered extremely cheap credit terms in India to attract buyers. Volkswagen had a scheme where you can buy a car and pay after a year. Similarly Audi was providing funding at 2.99%. This is possible as these companies can borrow in their home countries at very cheap rates. For example for both Audi & Volkswagen companies the 5 year borrowing costs will not be more than 2%. In this context they can offer cheap funding from their global balance sheet in other countries too. However an Indian car manufacturer would have cost of funding more near the 10-11% range. As such in a globalized world with low barriers high interest rates create a competitive advantage for MNC’s.

Over the course of the last three monetary policy statements the RBI has shifted the debate away from inflation to the Current Account Deficit. It is apparent that the slowdown in the upward spiral of food prices, the fall in global commodity prices by nearly 15-20% along with the total lack of pricing power with domestic manufacturers has led to a collapse in the moving average of inflation in the country. My expectation is that over the next three months we will see inflation collapse to 4.5%. Also contrary to what RBI says, the fall in demand combined with incremental capacity additions has now created a scenario in the country where there is enough surplus capacity in most industries both on the consumption as well as investment side. The areas where there is a shortfall, which is growing is in the area of raw minerals such as inputs for metals, coal, gas, petroleum products etc. Here the issue is of governance and getting projects which are on ground started and also pushing for investments in exploration activities. However this is something that we might not see in the course of the current government’s tenure. On the other hand, like I did write in a previous blog article the slowdown in the Chinese economy is creating a scenario where a large number of commodity prices might remain subdued for an extended period of time.

RBI along with the coterie of Armchair economists is propagating the logic of keeping interest rates high as the Trade Deficit needs to be funded and for that higher rates relative to the rest of the world will help us fund the deficit. The other risk factor that has been suddenly put out in the current policy has been that RBI is concerned with companies raising large amounts of ECB’s. However the reality is that if domestic interest rates are high & liquidity is kept persistently tight then what are the companies supposed to do. If the interest differential becomes as high as it is today where it is to the magnitude of 6-8% there will also be a greater propensity to keep the loans unhedged and expose themselves to forex risk i.e. of an INR depreciation.

What better time than now for a Sovereign Bond Issue

It is widely believed that it is RBI who has consistently opposed a Sovereign Bond Issuance. However my question is what better time will we get than today to raise fixed rate sovereign money. US 10 yr bonds today trade at 1.7%. The worst case for India to raise money at this stage when credit conditions are benign should be in the region of 3.5%. As a Sovereign the country can afford not to be hedged for a $ 20 billion borrowing which will be hardly 0.2% of GDP at the time of maturity. This will have three direct benefits, crowding out will be eliminated, government borrowing costs will come down & the INR will appreciate. Appreciation of the INR will have a direct impact on inflation which will trend down and give space to the RBI to reduce domestic rates. As such a strong virtuous cycle will start which will lead to significant growth revival. Today is the best time to raise USD funds for India as a Sovereign nation. RBI’s stance here is difficult to understand.

If the country raises money & domestic liquidity improves then companies do not have to go and raise ECB’s and as such that risk will get eliminated.

The risks of keeping rates too high

What keeping interest rates high effectively does it to bring in more of debt money and short term funds into the country. What we actually need is more long term money to come into the country in the form of investments in real projects or into primary equity. However for this the investors need to have a positive perception of the economy and growth prospects. In this regard the RBI is obviously right when it says that monetary policy without supporting government policies cannot lead to economic revival. However by keeping rates high money is coming into the country in the form of debt or quasi debt which eventually needs to be repaid. A large number of structures are being set up all around for investing money into Indian debt instruments. This is a bigger risk that the RBI needs to realize.

Composition of the Trade Deficit makes it clear that boosting exports and FDI is the only way out

and also that high interest rates have no impact of the CAD

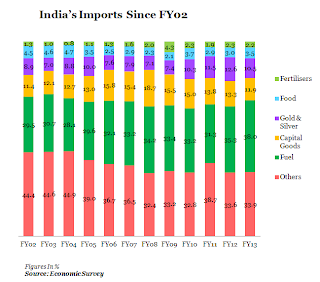

The composition of the Trade Deficit is such that Crude Oil imports and Gold imports are the two commodities which have been primarily responsible for the ballooning trade deficit. Besides this import of Edible Oil, Coal etc have also grown very rapidly in the last 5 years. On the other hand we have lost exports of Iron Ore to the tune of nearly $ 10 billion at current prices. Poor infrastructure, power shortages & increasing costs have made Indian manufacturing more and more noncompetitive.

Misplaced government policies over the last few years where utilities setting up power capacities were allowed duty free imports despite huge domestic capacities being set up has led to a huge growth in Capital Goods imports. However this should ease off in the near term as the investment cycle has virtually come to a standstill. Coal is clearly one sector that needs a drastic overhaul. Coal India’s production inefficiencies are costing the country precious foreign exchange reserves. However the GOVERNMENT trapped in Coalgate is unlikely to move on this front in the near term.

Gold consumption should stabilize as prices come down or remain stable. Overall my view on gold is strongly bearish and I believe that we could see another 20% coming off gold prices over the next few quarters. Crude imports are obviously a function of both prices and volume of imports. However it might not be wrong to say that the worst of the increase in deficit due to continuously rising crude oil prices might be behind us, at least for the next couple of years.

Under the circumstances a focused approach on boosting exports is necessary. The labour cost advantage with China has grown over the last three years as salaries have moved up sharply in that country. Lower interest rates & reduction of transaction costs could be helpful in boosting exports of labor intensive products going forward.

In the near term we have seen significant FDI flow proposals into the country, however in already established companies like United Spirits, GSK Consumer, Jet Airways, Hindustan Unilever & now Bharti Airtel. This shows that India is still seen as attractive by the promoters of these companies and strategic investors. The same needs to happen for Greenfield projects or in Infrastructure companies. Obviously the mess that the entire infrastructure sector is in today requires action from the government and not anyone else. In the last cycle we did see large number of Infrastructure projects in the country attract a large amount of FDI. The same cycle needs to be restarted. In the roads sector NHAI had proposed more of annuity and funded projects to be awarded. However nothing has moved on that. Annuity projects should be able to attract strong FDI from private equity funds.

Time to move away from text book economics

It is high time that our policies move away from text book economics. It’s a very different world today where new economic & monetary policies are being written every day. Our policy makers need to adapt and adjust to the same. How ironical is it that the US markets are today at all time highs, mid cap companies in the US are also at all time highs & the economy seems to be on the bend. This is the country that started the financial crisis in 2008 REMEMBER. At a time of QE’s, OMT’s, money printing by the Bank of Japan etc we still seem to be responding in the same traditional way. In our urge to control risks what is forgotten is that if there is a bubble being formed in the US and we are trying to pre-emptively fight it, eventually when they go down we will also go down although we might not have moved up accordingly. Forward looking policies are necessary. For example the Bank of England kept on printing money and kept policy rates at 0.5% despite the inflation going up to as much as 3% as they saw higher inflation as a passing phenomenon. This seems to be playing out well for them now as the economy has stabilized & inflation has started coming down.

Tight monetary policy & its benefits have run their course in India. By cutting the Repo rate while keeping liquidity extremely tight the RBI has ensured that there is no transmission of the monetary policy. It’s important to get the transmission going today. RBI’s fears of a run on the rupee are totally unfounded. Infact the INR needs a growth boost. If India is perceived as an economy that is growing faster we will attract much more long term money. High interest rates will however ensure that this does not happen.

In conclusion I believe that the entire argument that monetary policy is constrained due to the high CAD is extremely fallacious and does not take into account the reasons for the high CAD. The record high CAD has occurred at a time of very high interest rates in the economy not otherwise as such how will continued high rates bring it down.

Its wrong diagnosis and wrong prescription.